Stellar Submissions is a series of articles by MetricsDAO wherein we highlight bounty submission best practices by showcasing the grand prize winners of our bounty programs. Our goal with this is to sharpen the skills of on-chain analysts and raise the overall quality of bounty submissions.

In this edition of Stellar Submissions, we highlight the grand prize winners of the third round of our Olympus Bounty Program.

Grand Prize Winners

1. Supplement with curiosity

Dashboard: OlympusDAO User Activity

Author: J.Hackworth

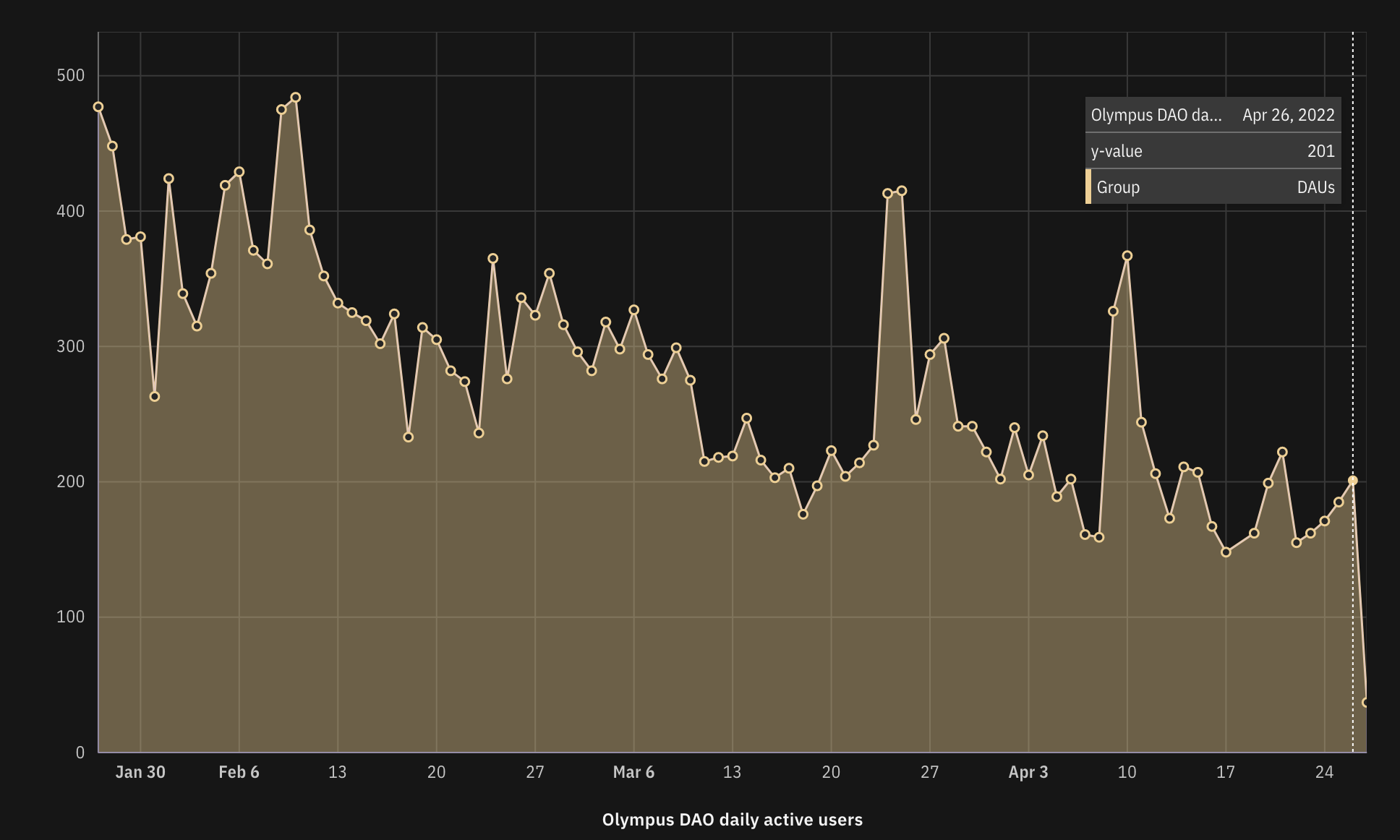

Stellar analyst J.Hackworth is back again for this round. This time he looks at the distinct active wallet addresses that use the Olympus protocol. In particular, he dives into the staking activity, possible price relationships, and new user trends.

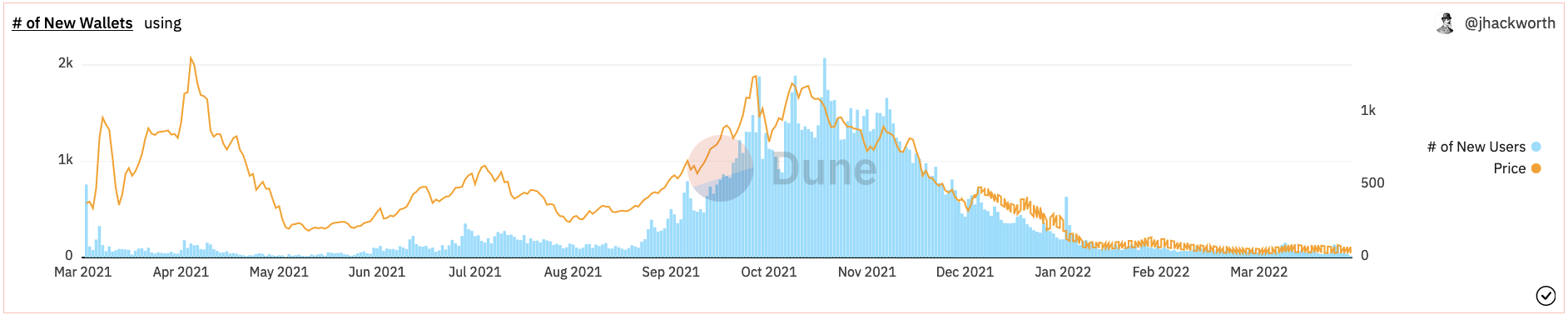

Key findings include that from February until April 2022, the number of daily new active Olympus users have been on the downtrend. This number has ranged from 50 to 100 a day which is a far cry from the high of 1,000 to 2,000+ daily new users back in November 2021.

This drop has coincided with the downward price action of $OHM. The token price of OHM and the number of new users have a correlation of 0.66.

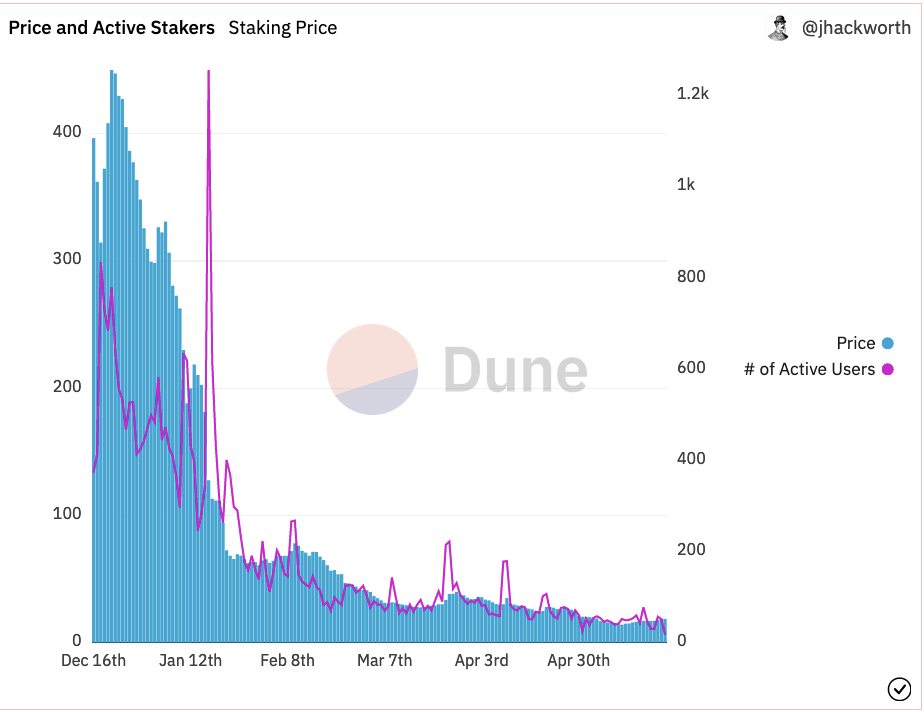

Looking at the number of active stakers specifically, this has also been going down together with the price of $OHM since late January 2022. These two values have a stronger correlation of 0.82.

This submission is a great example of letting one’s curiosity lead which allows for a more insightful analysis. J.Hackworth addresses the main bounty question head on by visualizing the total number of distinct wallets using the Olympus protocol which on a surface level shows an increasing trend.

He does not stop there as he also discovers that the number of new wallets using the protocol has been going down along with the OHM token price, leading to the insight that perhaps as the price of OHM has been going down, the interest in using the protocol has been going down as well. The analyst supplements this by also showing the decrease in the number of stakers in Olympus which is the protocol’s main value accrual strategy.

If you want to dive in deeper, check out the full analysis here.

2. Help the reader better understand

Analysis: OlympusDAO - Bonding Pools

Author: Zook

Bonding is a novel protocol mechanism introduced by the Olympus protocol. Protocols are able to own the liquidity for their assets through this mechanism. As explained by Zook in the context of Olympus, this is a process wherein users purchase discounted $OHM tokens using other assets such as stablecoins. He further explains that “once the bonding process is complete, OlympusDAO's treasury grows from the new assets it acquired which also provides collateral to back the value of $OHM tokens.”

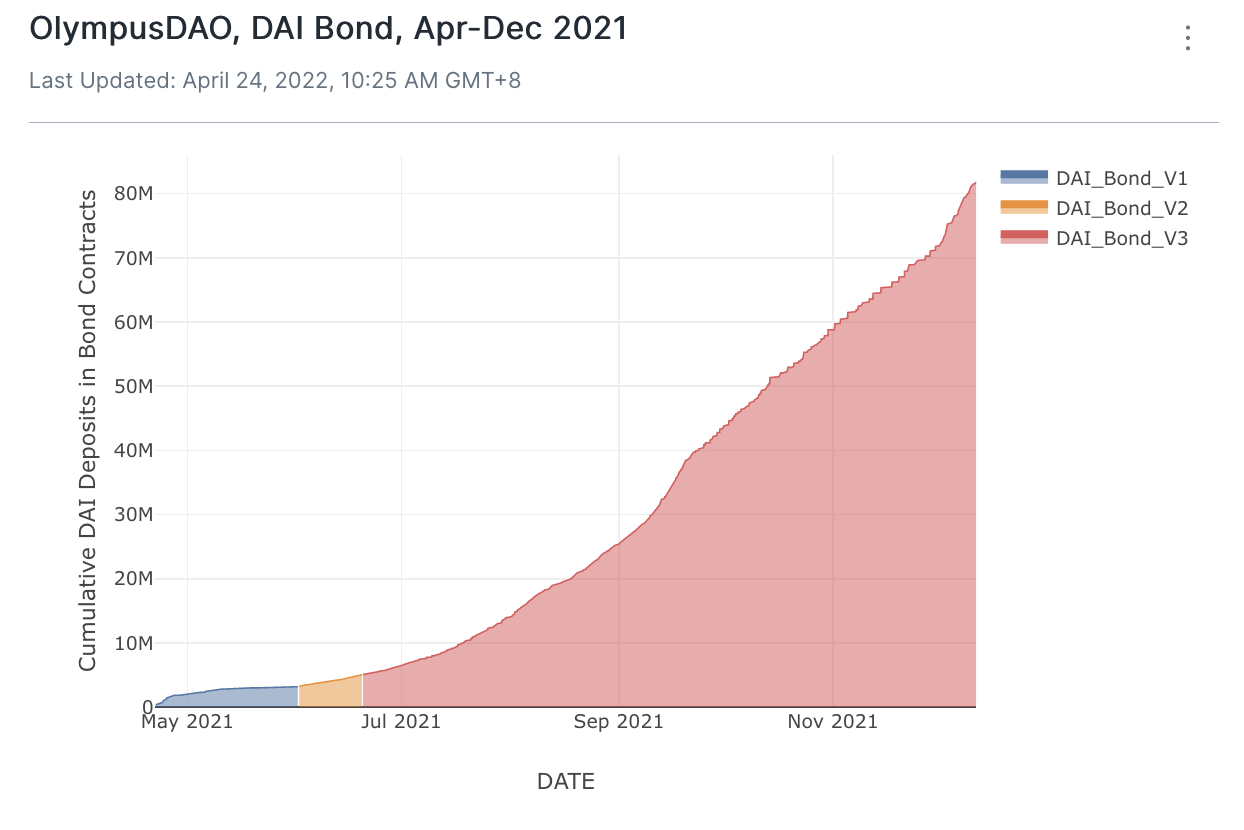

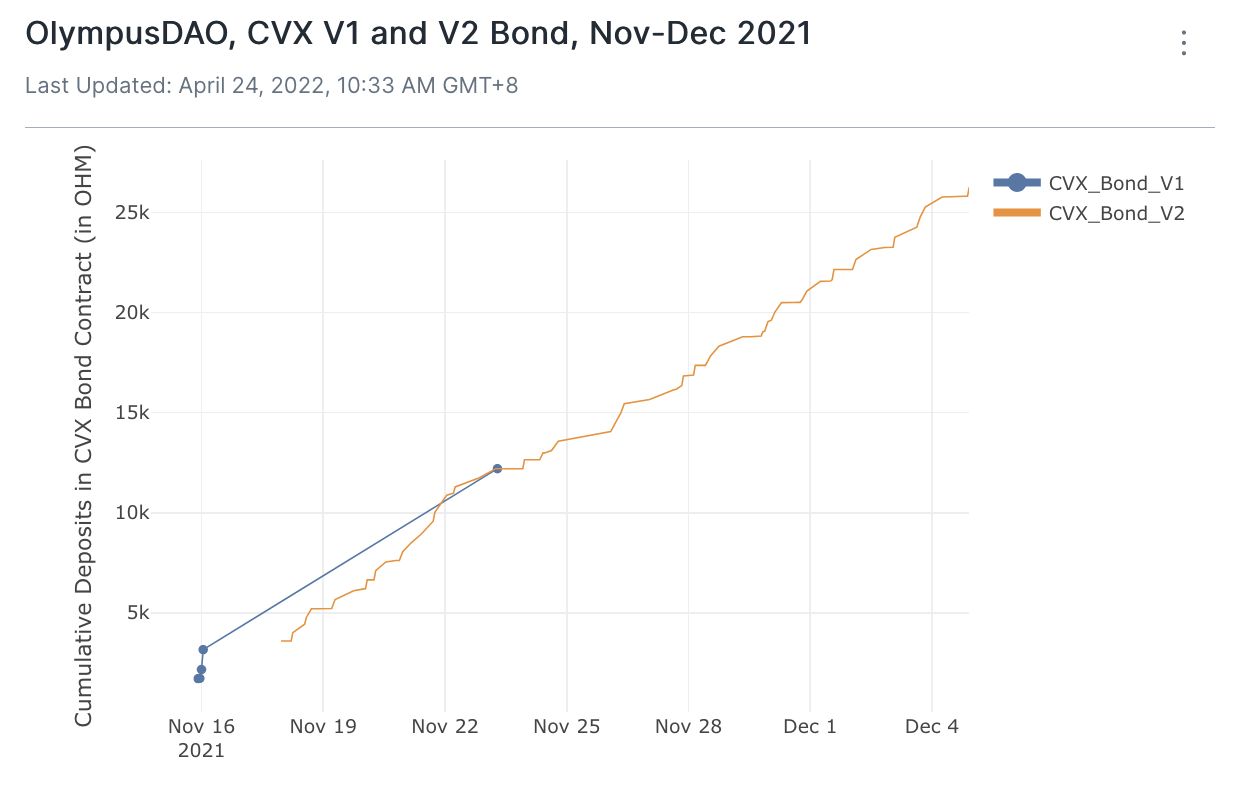

In his analysis, Zook looks into the bonding volumes over time of each of the five historical bonding pools, namely CVX, DAI, ETH, FRAX, and LUSD.

As seen from the chart, the DAI bonding contracts together raised USD 80M in liquidity, with the DAI V3 bonding contract raising USD 76M. This significantly increased the size of the OlympusDAO treasury.

In terms of the fastest filled-up bonding contracts, CVX V1 was the fastest at 9 days.

Olympus is one of the relatively new protocols that introduces a number of innovations making it one of the more challenging protocols to completely understand. Zook does an excellent job of breaking down the mechanism of bonding and the context as to why it was introduced in the first place. He guides the reader well all throughout his analysis, defining the metrics used, and avoiding unnecessary jargon.

Check out the complete analysis here where Zook also shows the cumulative bonding deposits of the other bonding contracts.

3. Put it all together

Dashboard: Olympus DAO Daily Active Users

Author: poogoo (aka Karl Lee)

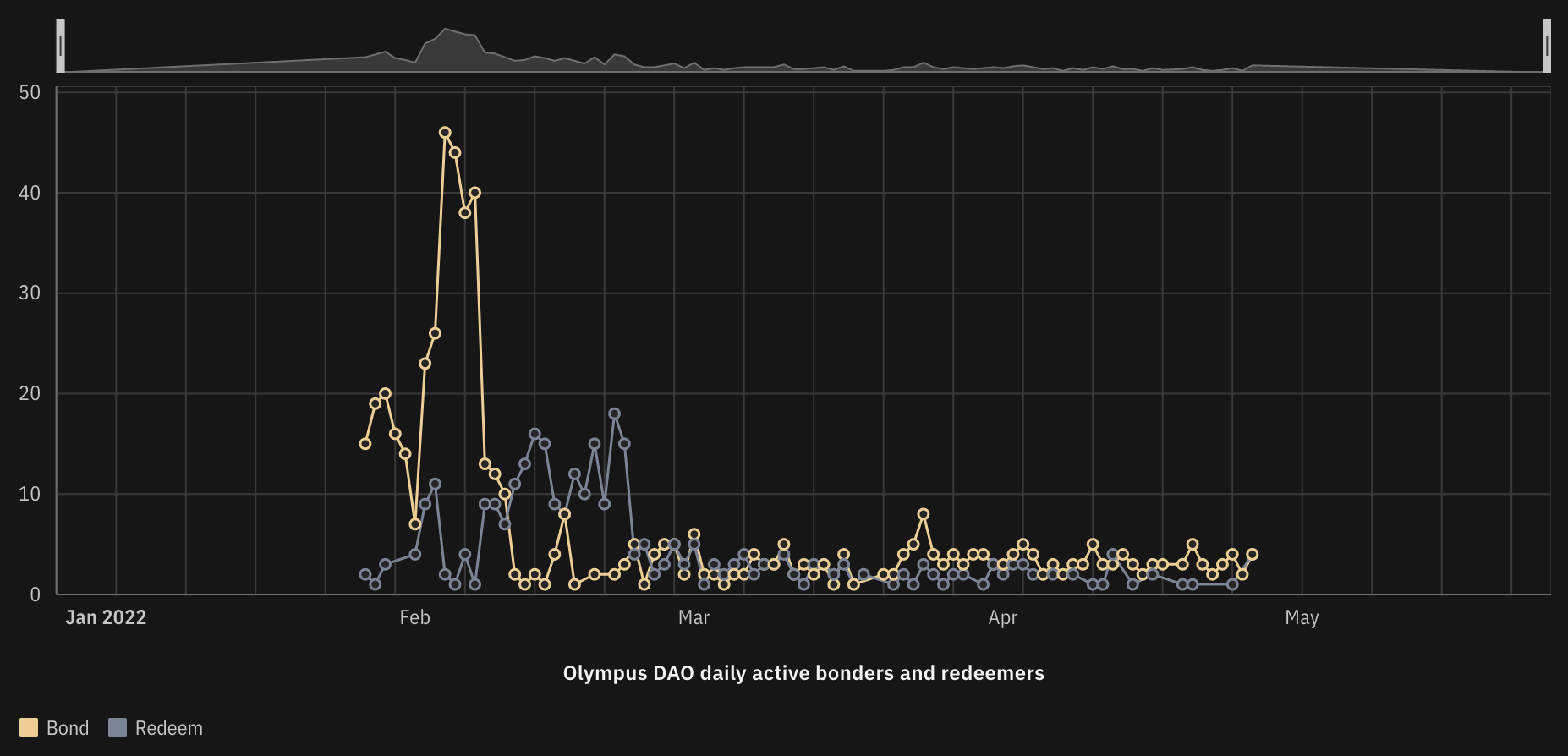

poogoo takes a closer look into the popularity of the Olympus protocol by focusing on the protocol’s daily active users (DAU). He defines active users as those wallets that participate in either $OHM staking, bonding, or governance activities. The analysis runs through late January 2022 until late April 2022.

Looking at active bonders and redeemers, these numbers have fluctuated below ten from March to April 2022 after both sets of users saw relatively high values around early February 2022.

Another key insight is how the token price of $OHM has had similar trends to the protocol’s daily active users across all types of activities. poogoo recommends that traders and users alike “keep DAU analytics top-of-mind when dealing with OHM price.”

In his analysis dashboard, poogoo combines multiple best practices: setting the context, clearly defining metrics, explaining the methodology, and effectively using visualizations. He starts off by explaining the context around the Olympus protocol and defines the key metrics he used for the analysis. From there he systematically goes through each type of active user, keeping the focus of the analysis in mind. He caps it off with clear takeaways and details his methodology which helps the audience verify his findings if they so choose.

You can view poogoo’s full analysis here wherein he also shares the resources he used to create this visually stunning dashboard.

3 Key Takeaways

-

Set the context early

A clear context sets the tone of the analysis and it also helps build the overall narrative. It is important therefore to have this set at the beginning of the analysis. The narrative brings everything together in a bounty submission.

-

Explain the methodology

The foundation of the analysis should be clear to the reader as it helps them understand the overall insight. Keep in mind that explaining the methodology further enriches the analysis so it is important to make the extra effort to detail this in the analysis where appropriate.

-

Be curious

More often than not, related questions arise from the back of your mind as you go through the analysis. There is a huge possibility that someone out there too has the same questions so addressing these peripheral questions will go a long way in further enriching your analysis.

Complete Set of Olympus Bounty Grand Prize Winners, Round 3

- OlympusDAO User Activity by J.Hackworth

- OlympusDAO - Bonding Pools by Zook

- Olympus DAO Daily Active Users by poogoo

Stay tuned for the next set of Stellar Submissions!

—

Want to share your own tips and best practices? Maybe you are ready to participate in a bounty program? Hop on over to the MetricsDAO Discord or follow us on Twitter to find out more.