What Is Aave?

At the very heart of the decentralized finance (DeFi) movement, is the permissionless lending and borrowing markets. The importance of lending and borrowing in a decentralized economy cannot be understated. First, it opens up the opportunity for users to get access to a wide range of assets by supplying a single asset which rarely happens traditionally. It also offers margin trading options and allows long-term investors to lend their assets and earn higher interest rates. So users are able to engage in these activities without the need for a traditional brokerage.

Initially launched in November 2017 as a peer-to-peer lending platform called ETHLend, Aave has championed DeFi innovation over the years and has earned “OG” status from the wider crypto ecosystem. The Aave protocol can be described as a non-custodial liquidity protocol, where customers can either supply assets, borrow assets, or perform liquidations. Suppliers provide assets to markets to earn interest while borrowers can take out assets by providing collateral. Liquidators are able to buy borrowers’ collateral at a discount when the collateral value is not able to properly cover their debt. Collectively, these enable a fully functioning protocol and provide powerful incentives to users to ensure the protocol’s integrity.

Aave V3

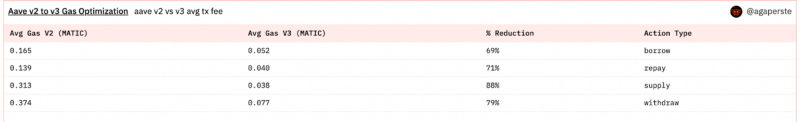

Aave V3 was launched in March 2022 and added more features and functionality to the protocol, including Portals for cross-chain transactions, a High-efficiency Mode for higher borrowing power, an Isolation Mode for new assets to be listed, and gas reduction of 20-25% across the board. Aave V3 is optimized to allow more modular community integrations and risk management capabilities to ensure that investors enjoy the highest capital efficiency and security. In addition, it includes upgrades to existing features such as aTokens, flash loans, stable rate borrowing, and credit delegation. Overall, V3 was deployed on six blockchains simultaneously, including Fantom, Optimism, Avalanche and Harmony.

Now, let’s dive into the new features that come with version 3 and how they fit in with Aave Protocol.

Capital Efficiency

For a liquidity protocol to continue to be competitive in the long term, it needs to give investors value for their money. This is exactly what the third iteration of Aave is doing with Portals, High-efficiency mode, and the Isolation mode.

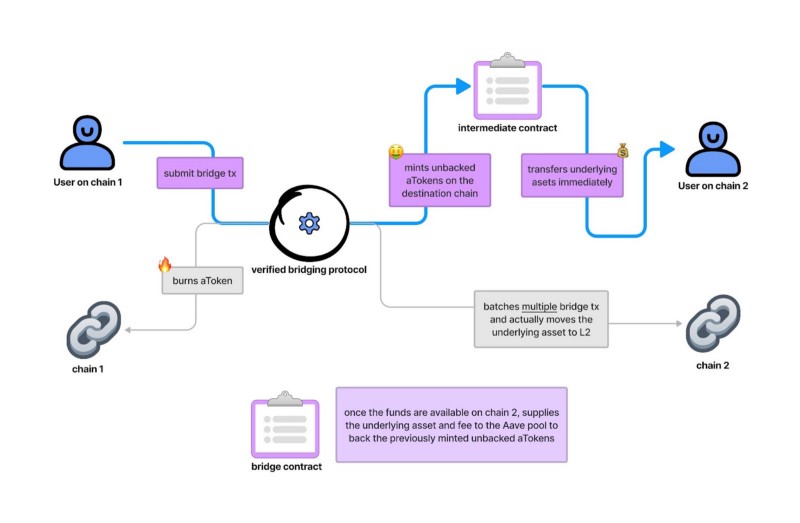

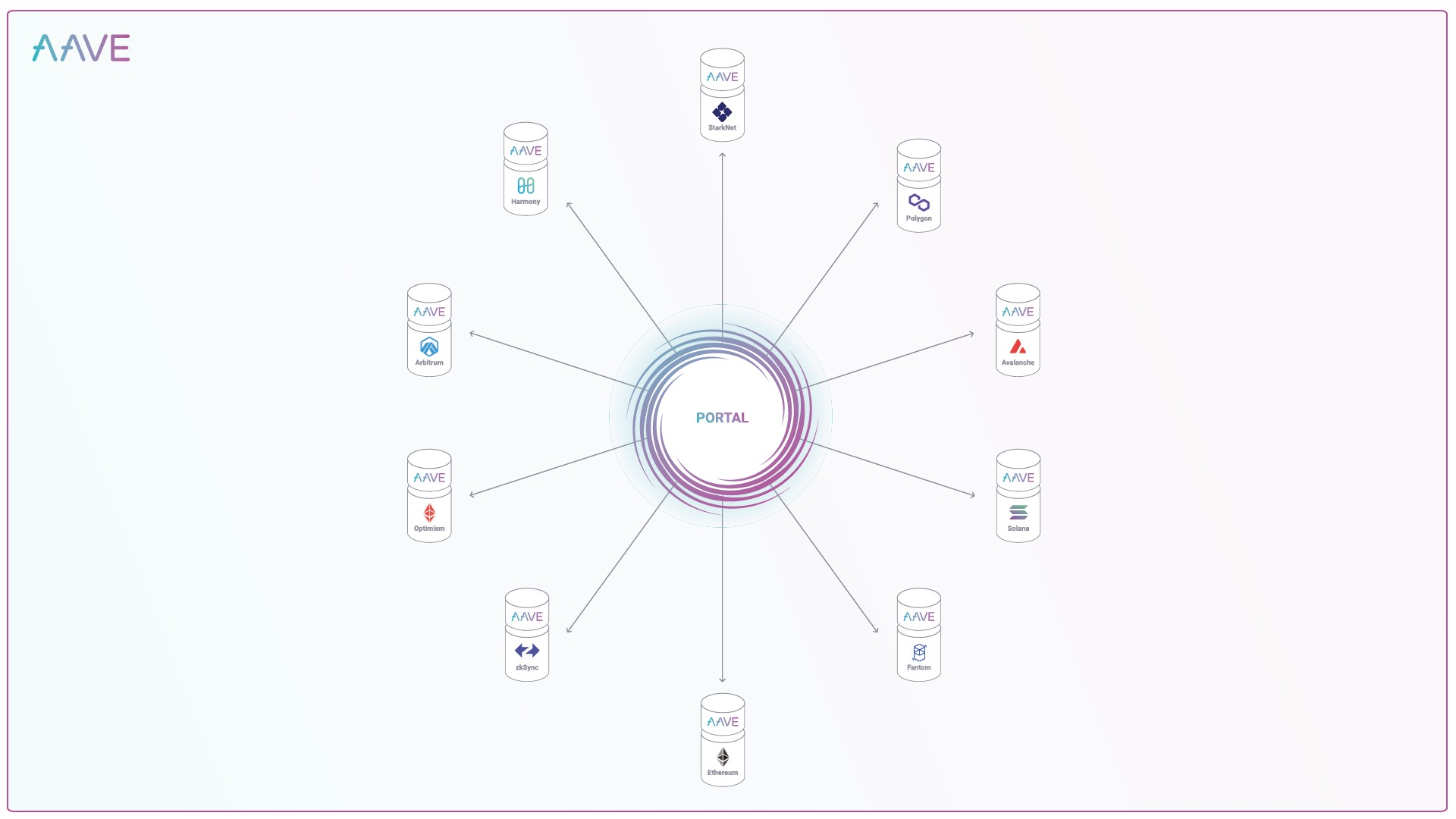

With Portals, users can move liquidity seamlessly between Aave V3 markets across different networks. V3 allows approved bridges to burn Aave Tokens (aTokens) on one bridge while simultaneously minting them on the destination network. The underlying asset is then supplied to Aave by sending it to the pool after it has moved through the bridge.

Portals will be very helpful to users wishing to move liquidity across chains by saving them gas fees while removing the additional steps required to move funds manually. Also, bridging protocols can leverage Portals to build novel solutions to tap into Aave Protocol liquidity to facilitate seamless cross-chain interactions.

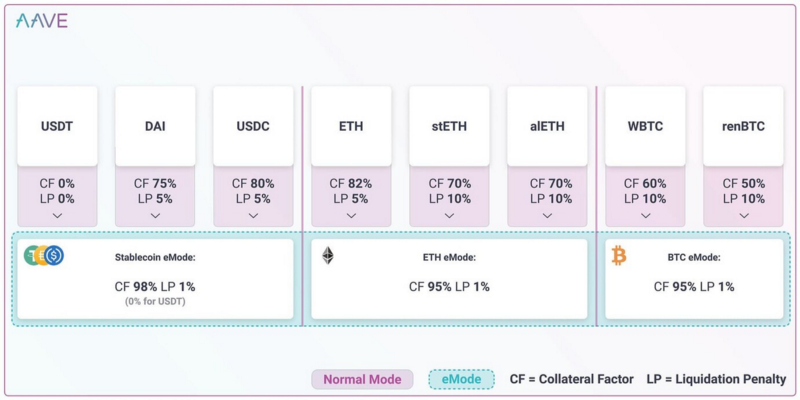

The High-efficiency mode or eMode, allows borrowers to extract the highest borrowing out of their collateral if the collateral and borrowed assets correlate in price or are derivatives of the same asset. An example of a situation where eMode can be used is when an investor supplies $USDC as collateral and borrows $USDT. High-efficiency mode can enable novel DeFi solutions such as high leverage forex trading, highly efficient yield-farming, and diversified risk management.

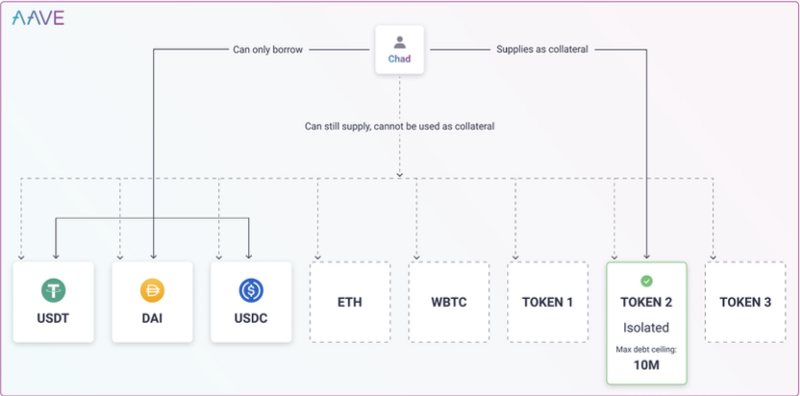

In V3, new assets can be listed as “Isolated”. This means that borrowers supplying isolated assets as collateral cannot supply other assets as collateral although they can still earn yield. The isolated mode allows users to take advantage of assets that were previously not allowed to be listed due to issues like the unavailability of price feed among others.

Borrowers supplying isolated collateral can only borrow stablecoins that have been permitted by the Aave governance to be borrowable in Isolation Mode, up to a specified debt ceiling. This is to mitigate any inherent risk an asset might pose to users’ funds.

Risk Management

As important as capital efficiency is in decentralized finance, it is equally important to manage threats to protect the protocol from becoming insolvent. With Aave V3, an “improved set of risk parameters” have been implemented, such as supply and borrowing caps, granular borrowing power control, risk admins, price oracle sentinel, and variable liquidation close factor have been introduced.

Aave governance can configure borrow caps to regulate how much of each asset can be borrowed thereby reducing insolvency risk. Similarly, the supply of a certain asset can be limited to reduce exposure and reduce the possibility of infinite minting and price oracle manipulation attacks.

In V3, it is possible to lower the borrowing power of assets to as low as 0% without affecting already existing users or to go with the old approach which could liquidate existing borrowers if deemed necessary.

Aave governance can also grant entities privileges to update the risk parameters without going through governance for every change. This opens up novel use cases where DAOs or automated agents could be granted these permissions to react automatically in case of events not anticipated such as false oracle price feed among others.

The oracle price sentinel feature was specifically developed for Layer 2s to handle the eventual downtime of the sequencer by introducing a grace period for liquidations and disabling borrowing under specific circumstances. Sequencers are block producers on L2 networks on which Aave relies for oracle price feeds, and their often downtimes, although short, could impact Aave users.

The liquidation mechanism has also been improved via the variable liquidation close factor which allows a position to be fully closed as it approaches insolvency. Previously, only half of the collateral could be liquidated at any point in time.

Extras

Apart from all the new features coming with the third iteration of the Aave Protocol to improve capital efficiency and risk management, users get additional benefits to advance the further decentralization of the protocol. In specific, Aave governance can grant roles to admins to create and set custom listing strategies for each asset listing. Also, it is now possible for an asset listing to enable additional incentives denominated in native pool tokens, and users can claim multiple reward types in a single transaction.

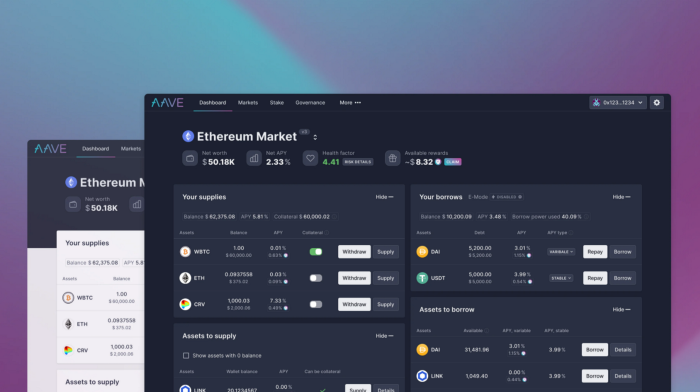

Last but not least, Aave V3 comes with a fully redesigned and refreshed user interface (UI) deployed to the InterPlanetary File System (IPFS) where users can experience a more improved experience and better transaction flows.

Alongside its bug bounty program, which incentivizes white hats to keep the protocol secure, Aave V3 has been fully audited by reputable names in DeFi security such as Sigma Prime, Trail of Bits, and Open Zeppelin, ABDK, and PeckShield.

For more data deep dives on other projects, check out MetricsDAO’s blog.