MetricsDAO analysts have been busily digging into the Tokenomics, Treasury, price and returns data and all things Olympus, over the last several weeks. From question generation through bounty submissions and review, we generated a large number of quality visualizations and data tables freely accesible to the community.

The diversity of submissions affords one the opportunity to see the same data from different perspectives, which can then be further analyzed with a ready to use table of data.

These analyses are publically available. Not only are the specific questions addressed, but one can easily extrapolate on the conclusions, iterating on the initial findings in a constantly evolving process to extract additonal insights.

As one who both submits and evaluates analysts’ submissions, I was exposed to a large amount of this data and came across a few insights which stand out.

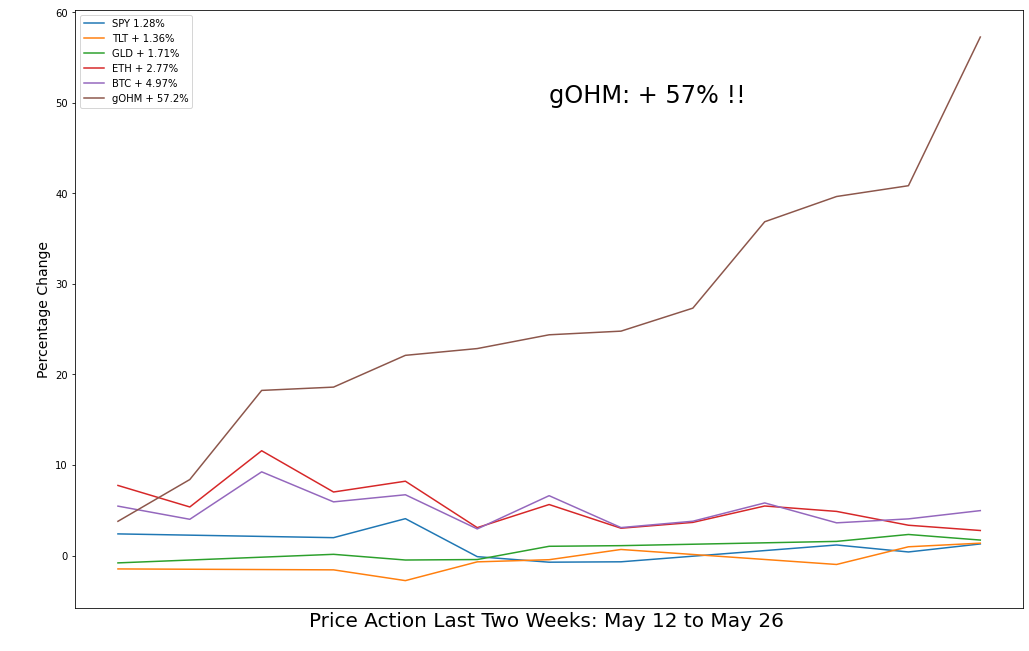

Insight # 1: The Price of gOHM has recently been outperforming traditional and crypto markets

A slightly overdramatized chart comparing stocks, bonds, gold, Ethereum and Bitcoin with gOHM

gOHM represents the returns on staking plus the compounding staking returns. More later. For now just think of a stock which pays dividends.

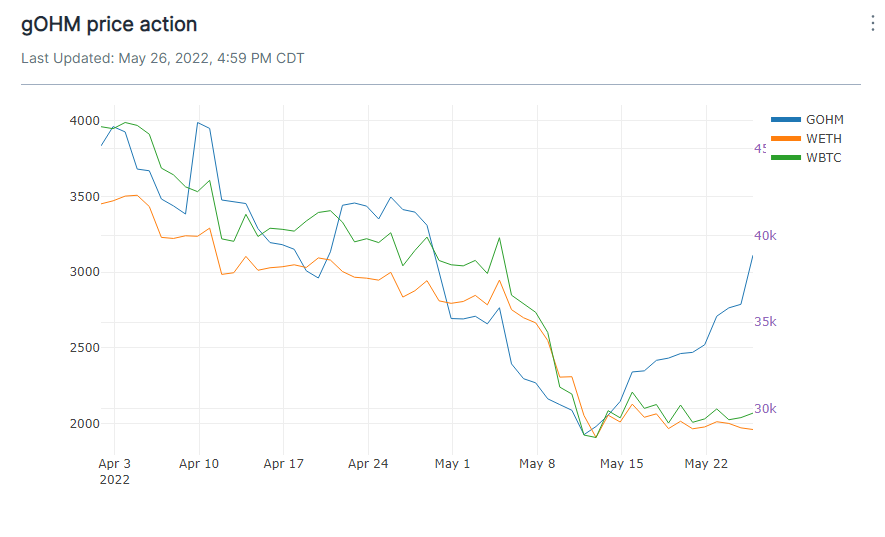

This graph definitely depicts a new pattern, as zooming back to the beginning of April, we can see that, for the most part, gOHM moved in step with BTC and ETH. One can construct narratives all day, in an attempt to explain why this is occuring and a two week interval is a ridiculously small time interval to consider, but it is certainly worth noting and a shot in the arm for long term OHM community members who have not had a lot to cheer about this year.

Zooming out for perspective: the price performance is a recent phenomenon

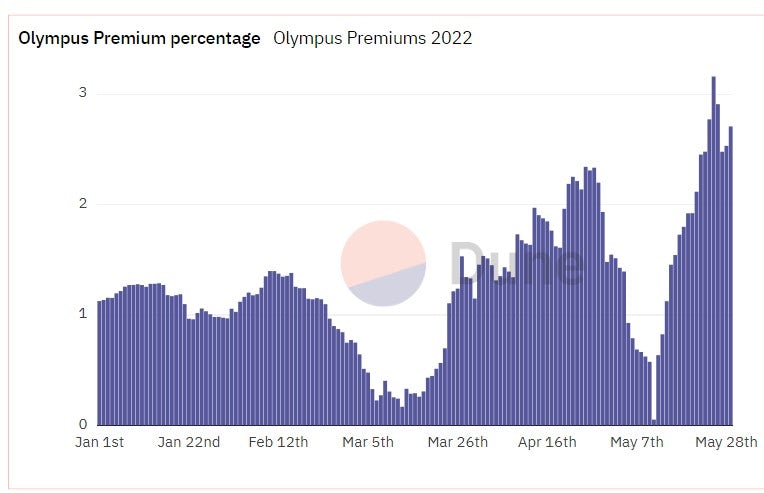

Insight #2: Bond discounts are at an all time high for the year

This is the discount received from “bonding”, reflecting the difference in the discounted rate of OHM, compared to the market. It is the principle mechanism which Olympus uses to build their reserves. When viewed as a percentage of price, we see a choppy distribution.

Comparing the premium percentage with price reveals the next insight.

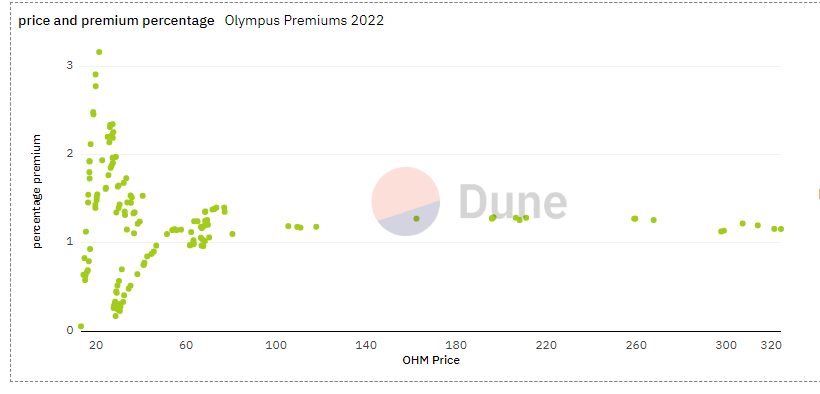

Insight #3: There is little, if any, correlation between the premium and the price

Premium rate at different prices

We do see that, when the price was higher than 100 dollars that there was a very consistent rate, just above 1%. The rate has jumped around significantly when the price is less than $50.

Insight #4: Staking the Olympus Way — Rebasing

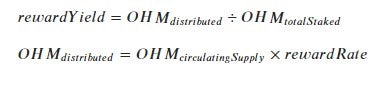

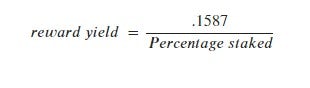

When you stake your OHM, you are entitled to a generous reward rate, which compounds three times a day. the gOHM governance token referenced above, in the sexy chart, is issued 1:1 for OHM. Instead of increasing your supply of gOHM, the reward is indexed and, at the time one unstakes, they get the appropriate amount. The reward received depends on two factors.

- The reward rate – Set by governance and approved by vote. Currently this is .1587

The "rebasing" reward yield formula

Simplifying a bit more we get

The reward yield formula. This compounds every 2200 Ethereum blocks which works out to once ever 8 hours or so or three times per day

Note that the yield formula is based on the assumption of a constant price of OHM. Therefore, given a drop in price from over 1000 to slightly below 20 USD, the rebase rate doesn’t help. Also, there is no rebasing if there is not an equivalent amount of reserves to back it.

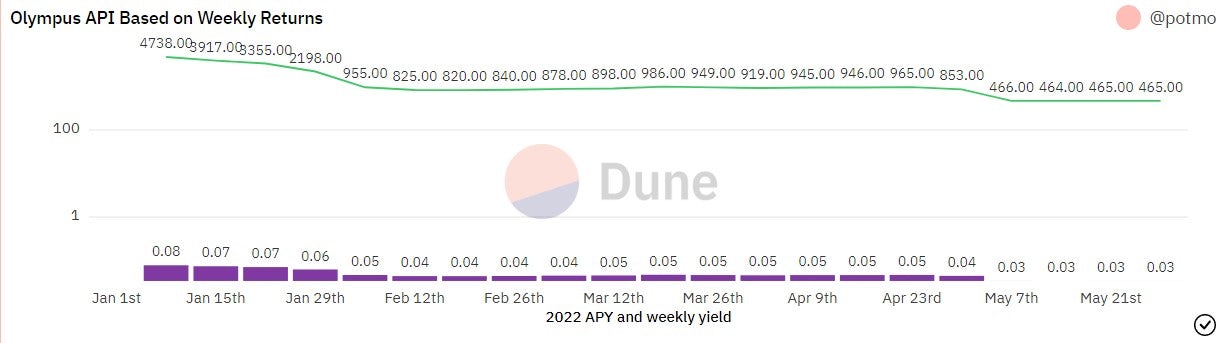

Good News: 465% APR Bad News: down from 4738%

Monthly yields and APY based on a constant OHM price

Sadly, the price action and the rewards can’t be separated, so it isn’t like you are receiving passive income. You only get that after you unstake. The declining APR to “only” 465% is a result of Olympus governance tweaking the rewards rate. It is not a result of the price drop directly, although price informs the decision. gOHM can be purchased on exchanges, and the yields are incorporated into the price. There is an index which incorporates the rewards rate and supply so you are automatically staking. There is no good reason to not stake OHM unless of course it is to sell.

Insight #5: Treasury Tracking is Tricky

A few weeks ago, one of MetricDAO’s bounty assignments was to track the Olympus DAO’s treasury balance over time. Most of the analysts operated under the assumption that the main treasury contract address contained the bulk of the assets.

Olympus Treasury. Left: Composite treasury assets for 2022. Right: the distribution of tokens in the treasury are comprised mainly of stable coins with WETH the exception. The OHM of course is not used to compute backing. The "other" sliver is a hodge podge of small experimental investments.

Not so!

In fact, there are eleven other addresses belonging to the treasury. This is part of the strategy of “protocol owned liquidity”. In addition to the “risk free value” backing, Olympus earns revenue through staking and providing liquidity to DEX pools as well as staking the protocols which they interact with.

Overall, we can see that it is primarily made up of relatively stable assets. Knowing what we know about algorithmic stable-coins and government crack downs, we can’t actually look at them as “risk free”, and with 8% allocated towards ETH, there will be some movement, but this is in line with the notion of a floating peg as opposed to reliance on fiat currencies.

Bonus insights:

-

Olympus owns over 99% of its liquidity

This may be the most important insight. It represents a new paradigm shift in the world of decentralized finance (aka DeFi) — rather than relying on predatory “yield farmers”, who will run the moment the rewards go away, dumping on the protocol and leaving the latecomers holding the bags. They also are supporting other protocols in the space, helping them with their liquidity.

-

Recently Released “inverse bonds” add an important weapon to the Olympus arsenal.

When price is declining, these bonds are issued to absorb selling pressure. These are only in place when there is reserve backing. While the ultimate goal is to continue to increase the supply of OHM, it must be managed carefully and reducing the supply, at a discount, helps protect the price. In a bull markekt, the priority is on building up the reserves.

Overall Insight:

The Olympus protocol is multi-faceted and was a real challenge for the bounty contestants. Price action, treasury balance, staking rewards, bonding premium data comes to life when collective analytical minds are able to bounce ideas off each other, armed with curated, publically available data.

Thanks to @rplust, @sociocrypto, @zook, @marqu, @jhackworth and anyone else I missed for your analyses and queries.

I found three great Dune dashboards on Olympus

our very own @ilemi aka Andrew, genesis member of “OurNetworkLearn” and of course Mirror.xyz fame, did a very nice description of the bonding process:

@shadow produced this and several other dashboards on Olympus/ OHM

Last but not least, @fluidsonic, who produced this gem