A collective network of analysts, working to provide insights on demand, across the globe. It’s a fantastic and useful concept on paper. Once the details are sorted out, it’s an incredible one. However, it’s also a large and complex concept once you dive into all of those different variables. Metrics DAO is a bold undertaking, but with a careful look at every piece in the puzzle, there is a lot of value.

Okay so we have the analysts working on projects all over.

How do we get the analysts? Incentives.

Compensation? Well what kind?

Finding the right answer here could prove to be valuable in the long term.

Context

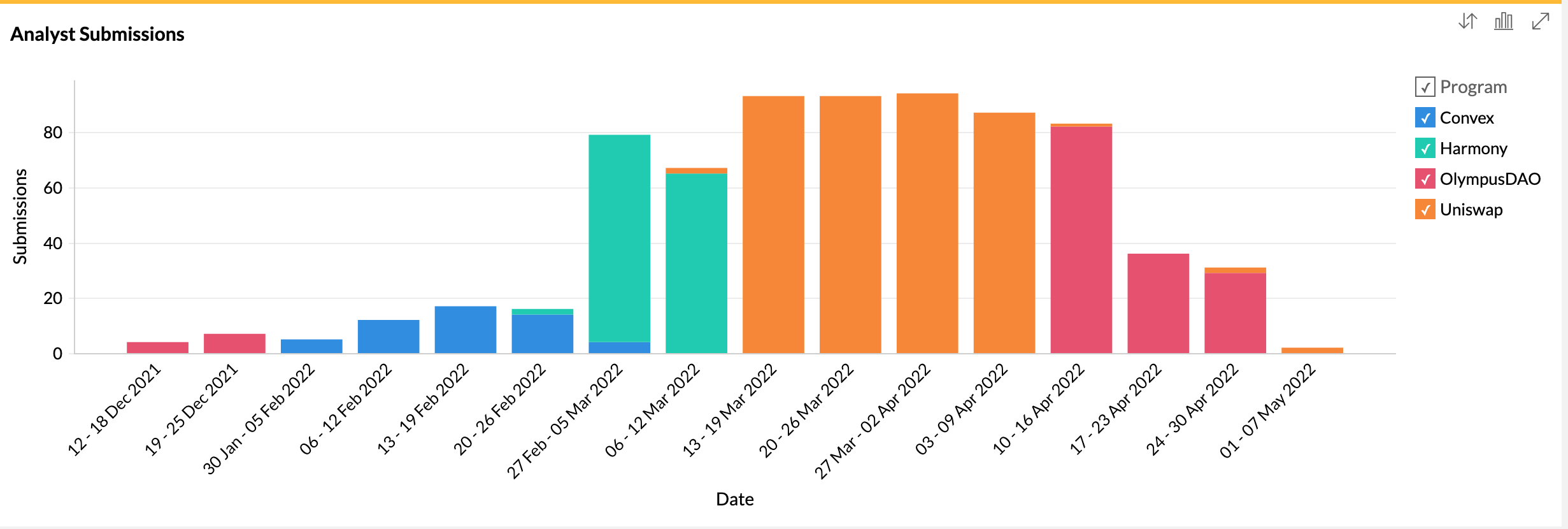

The majority of our bounties for the past few months have dealt with Harmony, Uniswap, or Olympus. The results have been encouraging, we’ve seen solid submission volume for most of 2022. Payment has been in the native token of whatever program the bounty is related to each week. This was going well until recently, we’ve been seeing a decline in bounty submissions, and payment method could potentially be one of the driving forces behind this drop.

Here’s a quick look at our submission numbers. Between Late February and mid April we saw a consistent number of submissions each week even after switching from Harmony to Uniswap. However, after the first week of Olympus bounties, we see a relatively steep decline.

Most tokens are due to experience relatively high volatility, this is no surprise. Due to that volatility however, paying analysts in tokens may be an attractive or unattractive deal to them, depending on a variety of factors. Current price, program status, analyst’s personal attitude, and even an analyst’s personal risk tolerance are all taken into account when paying bounties in tokens. Could the right token help coerce analysts into regularly submitting bounties? Could the wrong token scare them away? Valid questions.

Proposal

What about stablecoins? They provide the same level of liquidity within the Web3 trading space, yet remove some of the volatility from the equation. Paying analysts in tokens may provide enhanced results when the respective programs are performing at their usual level, however when an asset begins to lose market value, it could hurt submission volume. As an example, when a potential analyst sees a chart like this OHM example below from the past month, they may look into other options instead.

Next Steps

Paying users in stablecoins is the next logical step. This provides analysts an extra reason to work on bounties across a variety of programs since they no longer need to have any interest in receiving program tokens as compensation. Stablecoins are liquid enough across trading protocols that users will have no problem using them, yet still have the ability to hold onto them for future use. It will be interesting to see if we see a more consistent stream of bounties with this method (less contingent on market conditions), or if users prefer being paid in tokens. Maybe the answer is providing a few options so analysts can choose after submission.

We will continue to investigate and refine our bounty process overall. Trying stablecoins will be an interesting experiment, but certainly not the last. Perhaps the recent drop in submissions is due to something else entirely, also possible. However, with the team at MetricsDAO looking into it, answers are bound to be found.

Interested in joining? Get started with Olympus bounties to earn USDC here!